geothermal tax credit extension

Congress authorized a 30 investment tax credit to be claimed on new power plants of up to 50 megawatts in size that generate electricity using waste heat from buildings and other equipment. In December 2020 the tax credit for geothermal heat pump installations was extended through 2023.

Nuclear Power Production Tax Credit Extension Bill Potential Vehicle For Orphaned Technologies

In December 2020 the tax credit for geothermal heat pump installations was extended through 2023.

. Geothermal equipment that uses the stored solar energy from the ground for heating and cooling and that meets ENERGY STAR requirements at the time of installation is. This number will carry through until the end of 2022 and drops to 22 in 2023. The extension keeps the wind energy PTC in effect through 2012 while keeping the PTC alive for municipal solid waste qualified hydropower and biomass and geothermal energy facilities through 2013.

You must also submit Form 5695 the Residential Energy Tax Credit. As lawmakers hotly debate budget cuts and tax reform in Washington DC the Geothermal Exchange Organization GEO has formally asked the US. In December 2020 the tax credit for geothermal heat pump installations was extended through 2023.

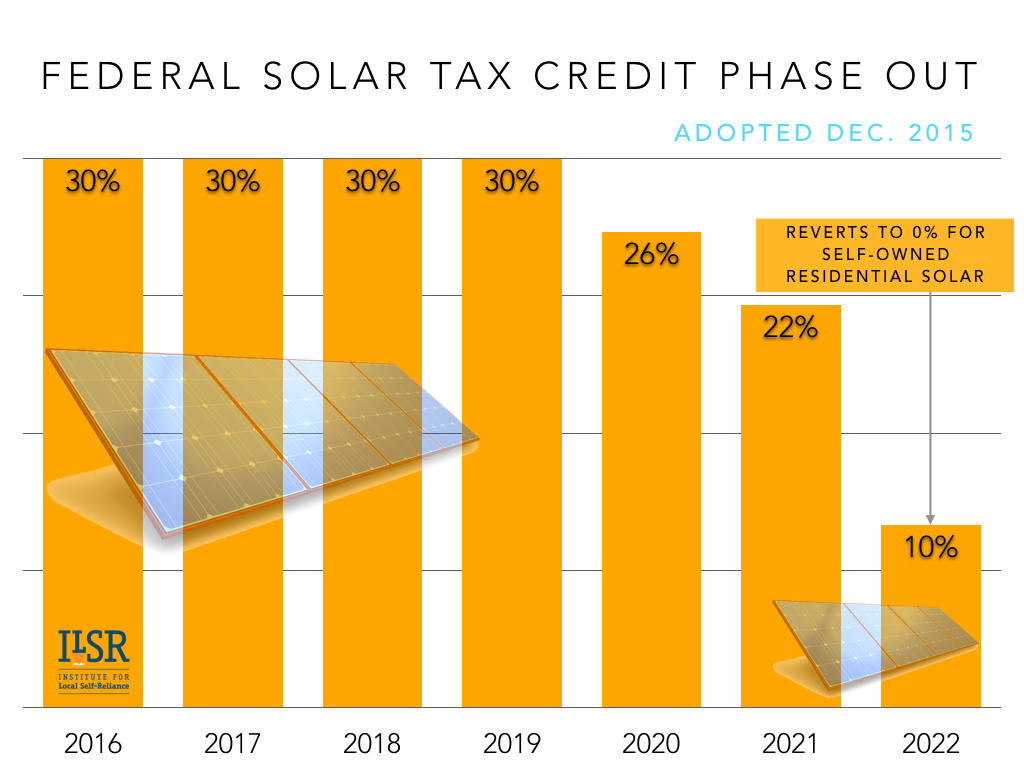

Property is usually considered to be placed in service when installation is complete and equipment is ready for use. This would mean a 30 tax credit through 2024 a 26 tax credit in 2025 and a 22 tax credit in 2026. Geothermal heat pumps are similar to ordinary heat pumps but use the ground instead of outside air to provide heating air conditioning and in most cases hot water.

A 30 tax credit for the installation of a ground source heat pump geothermal system with no cap was enacted in 2009. Commercial credits will remain at 10 through 2023. The 26 federal tax credit was extended through 2022 and will drop to 22 in 2023 before expiring altogether so act now for the most savings.

In addition a two-year extension of the PTC for marine and hydrokinetic renewable energy systems will keep that tax credit in effect through 2013. Residential Energy-Efficient Property Credit. Geothermal Tax Credit Extended.

A 26 percent federal tax credit for geothermal installations was extended for two more years. Ultimately the tax credit was reinstated in early February 2018. House of Representatives Ways and Means Committee to recommend extending federal tax credits for residential and commercial geothermal heat.

The extension keeps the tax credit at 26 for residential geothermal for 2021 and 2022. This Tax credit was available through the end of 2016. The extension is good news for those considering the benefits of geothermal.

Provided your heat pump meets these minimum specifications the process of applying for a geothermal tax credit is simple. For this reason you should consider helping this pass through. Federal Geothermal Tax Credits have recently been amended thus you may have 26 Federal Geothermal Tax Credits to get for systems installed by Jan.

In 2019 the tax credit was renewed at 30 of the total system cost which dropped to 26 in 2020. APPLYING FOR TAX CREDITS. As we mentioned before the geothermal tax credit goes through cycles of reinstatement expiration and renewal within the US.

Christmas came early for the geothermal industry when the latest federal stimulus bill included a long-sought extension of tax credits for geothermal installation. The new legislation lengthens the deadline for the credits for GHP installations. The credit has no limit and theres no limitation on the number of times the credit.

Extension for commercial and residential geothermal heat pump GHP tax credits. Because they use the earths natural heat they are among the most efficient and comfortable heating and cooling technologies. Residential credits are 26 through 2022 then decrease to 22.

The extension was part of the federal governments 900 million COVID relief package passed by Congress in December 2020. A 26 federal tax credit for residential ground source heat pump installations has been extended through December 31 2022. Keep all receipts from the purchase and installation of your geothermal unit and submit them when its time to file your taxes.

The Iowa Geothermal Tax Credit is effectively a 52 credit based on a formula of 20 of the federal residential energy-efficient property tax 24. In July a bill was introduced to the House and Senate to push for a five-year extension of the 30 tax credit for Geothermal systems. From 2017 to January of 2018 there was an ongoing fight to extended this tax credit.

The federal tax credit for geothermal installations was extended for two more years at the end of 2020. The credit then steps down to 22 in 2023 and expires January 1 2024. In 2023 and expire January 1 2024.

Help Extend The Geothermal 30 Tax Credit Through 2024. Geothermal Tax Credits Extended Smart Choices Harrison. Geothermal equipment that uses the stored solar energy from the ground for heating and cooling and that meets ENERGY STAR requirements at the time of installation is eligible for the tax credit.

New geothermal heat pumps and combined heat and power projects will qualify for a 10 investment tax credit if construction starts by the end of 2023. GEO Seeks Extension of Federal Tax Credits for Geothermal Heat Pumps. It keeps the tax credit at 26 percent for residential geothermal for 2021 and 2022.

Existing tax credits were set at 26 throughout 2020 22 throughout 2021 and falling to zero at the end of 2021. Now geothermal tax credits will stay at 26 for 2021 and 2022 before falling to 22 in 2023.

2013 Wind Turbine Federal Tax Credit Passed Wind Turbine Wind Power Wind Energy

Geothermal Heat Pump Tax Credits Approved By Congress Geothermal Heating And Cooling Chesapeake Geosystems

House Passed 1 7 Trillion Build Back Better Reconciliation Legislation Includes 325 Billion In Green Energy Tax Incentives And More Than 92 Billion In Spending To Address Robust Climate Change Goals Novogradac

Geothermal Investment Tax Credit Extended Through 2023

Thinking About Going Solar This Year And Heard About The 30 Itc Learn What It Actually Is Hint It S Not An Income Tax Credit Solar Solar Energy Alternative Energy

Breaking News Solar Itc Extension Through 2023 Energylink

Congress Gets Renewable Tax Credit Extension Right

Here S How To Take Advantage Of The Solar Tax Credit Extension In 2021 In 2021 Solar Solar Panel Repair Tax Credits

Solar Investment Tax Credit Itc At 26 Extended For Two Years Creative Energies Solar Solar Design Residential Solar Passive Solar Design

Geothermal Investment Tax Credit Extended Through 2023

How The Itc Extension Ensures Future Growth Of Solar For Homeowners And Businesses Solar Solar Energy Growth

Go Green Power Gg 13725bk 16 3 25 Heavy Duty Extension Cord Black Outdoor Extension Cord Extension Cord Green Power

Pin By Damien Williams On Earth Wind Energy Wind Map Wind

Congress Gets Renewable Tax Credit Extension Right

Could We See A Federal Solar Tax Credit Extension In 2021 Solar Sam

Understanding The Geothermal Tax Credit Extension

2 2 Impact Of Itc Extension On U S Solar Industry Source Bnef 34 Download Scientific Diagram

Nuclear Power Production Tax Credit Extension Bill Potential Vehicle For Orphaned Technologies

Cost Of Solar Energy Dropped 30 In Year Trump S Coal Visit Solarpowercee Com For The Latest Solar Products Solarene Solar Energy Solar Solar Energy System